2024년 7월 2일 주식 시장

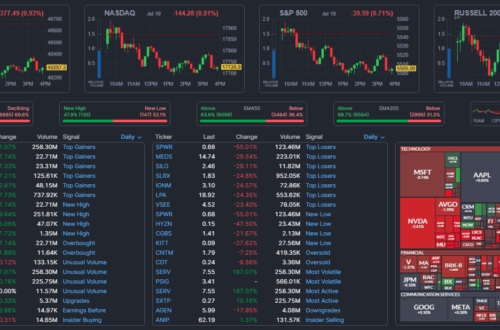

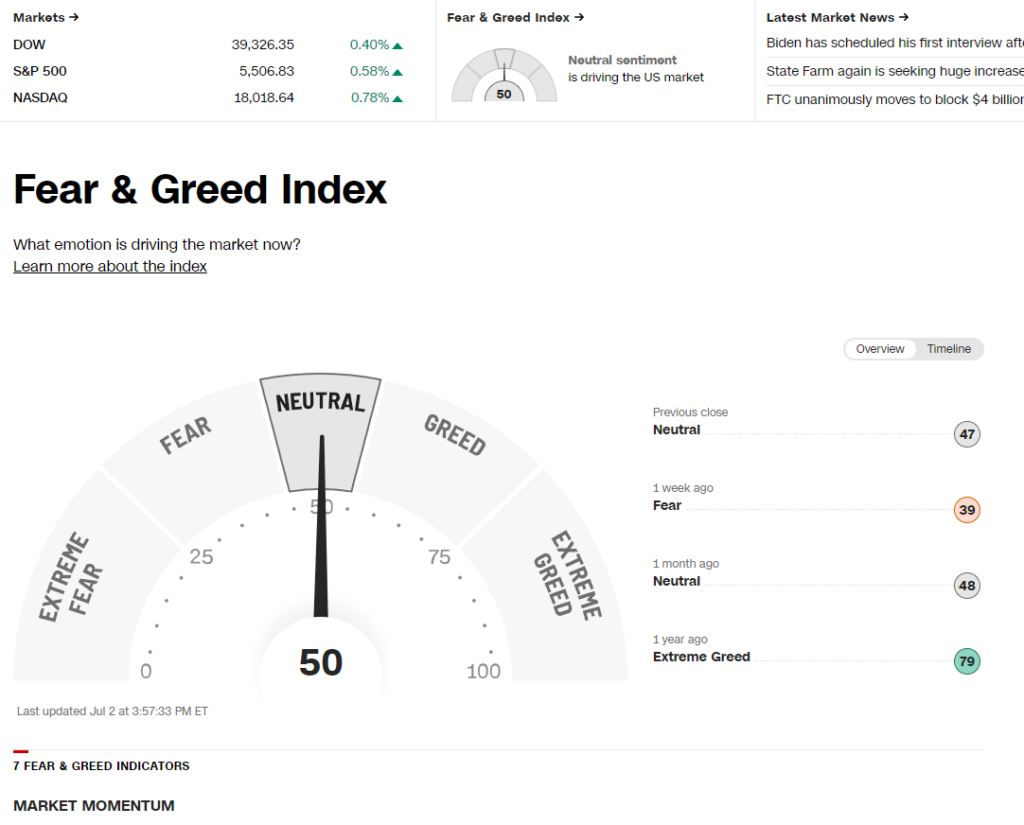

변동성은 중립을 지키는 중에 빅텍과 테슬라는 대박이 났다. 어제 오늘 엄청난 상승을 이끌고 있다.

전반적으로 상승 이였다. 7월 변동성이 낮을 것이라 예상하고 수급이 크지 않을 거라는 예측가운데 역시 테슬라는 이날을 노리고 있었던것 같다. 2분기 차량 인도가 예상을 뛰어 넘었고 여러 언론 플레이로 주가을 끌어 올렸다.

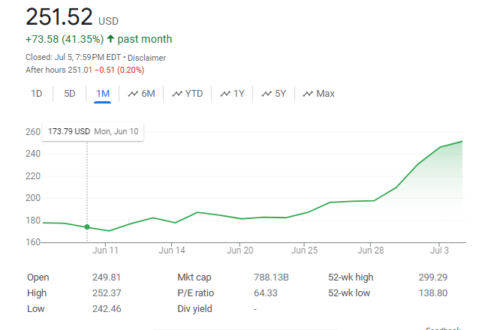

간남에 아름답게 올라 주고 있다. 콜옵션 220불이 다 터져버려서 얼마나 더 들어 올지는 모르겠지만 들어 오는 수급만으로 올려야 되기에 앞으로 몇일은 크게 오르는 일은 없을것 같다. 수익실현을 하는 사라들도 있을 것 같은데. 어째든 200일 평균이동선을 훌쩍 넘어 버리는 귀염을 ㅋㅋ

10:56 AM EDT, July 02, 2024 (Benzinga Newswire)

Tesla Inc (NASDAQ:TSLA) shares are trading higher Tuesday after beating consensus estimates for second-quarter deliveries.

Here’s what analysts and Tesla investors are saying after the report.

Wedbush on Tesla: The worst could be behind Tesla after second-quarter deliveries beat estimates, Wedbush analyst Dan Ives said in a note.

“This was a huge comeback performance from Tesla and Musk with the Street expecting a clear miss this quarter with EV demand still choppy globally,” the analyst said.

Tesla reported second-quarter deliveries of 443,956 compared to a Street consensus estimate of 437,800 shared by the company.

“It appears China saw a ‘mini rebound’ in the quarter along with pricing stabilization that helped Tesla battle through headwinds to deliver a much stronger delivery quarter than even the bulls were expecting,” Ives said.

The Tesla delivery results will likely be “music to the ears of the bulls” ahead of the second half of 2024, he said.

Ives maintains an Outperform rating on Tesla with a $275 price target.

Other Tesla Delivery Reactions: Tesla forecaster Troy Teslike had an estimate of 423,000 deliveries for Tesla’s second quarter.

“Deliveries were clearly higher than I expected. It looks like Tesla managed to reduce Model 3 and Model Y inventory in the US significantly,” Teslike tweeted.

Fund manager Gary Black said the second quarter deliveries were a “big beat” in light of sentiment being poor ahead of the deliveries data.

“Strong result increases odds that TSLA will extend favorable low interest financing into 3Q, rather than additional price cuts. Big positive is huge inventory drawdown,” Black tweeted.

Black called the second -quarter deliveries a “fantastic result” in another tweet.

YouTuber and Tesla investor Dave Lee highlighted the delivery figure and the 9.4 GWh of energy storage the company deployed in the second quarter.

Tesla’s energy storage was the highest quarter in company history and came in higher than a first-quarter total of 4.05 GWh.

“Impressive quarter that will show big improvements in earnings compared to last quarter. Congrats Tesla,” Lee tweeted.

What’s Next For Tesla: Ives is looking forward to Tesla’s robotaxi day on August 8.

“The worst is in the rearview mirror for Tesla as we believe the EV demand story is starting to return to the disruptive tech stalwart ahead of a historical Robotaxi Day on August 8th,” Ives said.

Ives calls the second-quarter delivery beat “the appetizer to the main event.”

Robotaxi day will “unleash the next part of the Tesla autonomous story with all the Street watching,” he said.

Ives said robotaxi day is a key to Tesla returning to a $1-trillion market capitalization.

“We continue to believe that Tesla is more of an AI and robotics play than a traditional car company…now the rubber meets the road as the Street anticipates August 8th as a key linchpin day for the Tesla story.”

Tesla is slated to report second-quarter financial results July 23 after market close. Analysts expect the company to report earnings per share of 60 cents and revenue of $24.19 billion in the quarter, according to data from Benzinga Pro.

The company has missed analyst estimates for both earnings per share and revenue in each of the last three quarters.

TSLA Price Action: Tesla shares are up 8.6% to $227.94 on Tuesday versus a 52-week trading range of $138.80 to $299.29.

사실 내일도 오전장만 하는 날이고 독립기념일 휴장이라. 지금 팔고 싶은 맘이 근진근질하네 ㅜㅜ 그래도 참자.

조정이라는 단어를 쓰지만 어째든 개미털기 시작인가 하는 생각이 든다. 한번더 떨어 지면 못버티고 던지는 사람 속출할텐데. 지금도 훌덜거릴 것 같다. 누군가의 수익 실현이 그래서 꼭지에서 못 먹는 다니깐 ㅜㅜ

Semiconductor stocks are bubbling and could lose 40% of their value

Parallels to the top of the internet bubble are too obvious to ignore.

Nvidia Corp.’s recent dive into correction territory is most likely the beginning of something far more serious for Nvidia and other semiconductor stocks.

That’s the implication of recent research into market bubbles and their eventual bursting. The research suggests it’s “nearly certain” that, at some point in the next two years, the market value of Nvidia (NVDA), as well as the semiconductor industry generally, will be down 40%.

This forecast emerges from research conducted by Robin Greenwood and Andrei Shleifer of Harvard University, and Yang You of the University of Hong Kong. Their study, entitled “Bubbles For Fama,” was published in the Journal of Financial Economics. They found that the more an industry outperforms the S&P 500 SPX over the trailing two years, the greater the likelihood it will crash. The researchers define a crash to be a 40% drop over the subsequent two years.

When an industry’s trailing two-year alpha – the margin by which it beats the market – is 100 percentage points, according to the researchers’ calculations, the probability of a crash is 53%. It grows to 76% when the alpha is 125 percentage points, and to 80% when the alpha is 150 percentage points. Above that, a crash becomes “nearly certain.”

The semiconductor industry’s trailing two-year alpha currently is just shy of 200 percentage points. Nvidia’s is more than 600 percentage points.

Dot-com bubble 2.0

The parallels to the bursting of the internet bubble are obvious, since in the late 1990s several dot-com stocks far outpaced the S&P 500 and then crashed. There’s another parallel with the March 2000 top of that bubble that is less obvious, however: Investors reacted to the initial correction off that top as a buying opportunity. That is a hallmark of a major top, according to contrarian analysis.

Consider the average recommended equity exposure in March 2000 among a subset of Nasdaq-focused short-term stock- market timers. (This average is what’s reported in the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.) Instead of falling in the wake of the Nasdaq Composite’s COMP initial 10% correction from its bull-market high, the HNNSI actually grew more than 30 percentage points. That meant that investor bullishness had reached exuberant levels. We all know what happened next.

We may be seeing something similar today in investor reaction to Nvidia’s recent correction – which saw the company’s stock drop 16.1% on an intraday basis in just two trading sessions. Though it’s impossible to know how many investors are treating this correction as a buying opportunity, it’s clear from my review of the investment blogosphere that a considerable number of them are doing so.

Track record

This isn’t the first time I’ve relied on the Harvard study to make crash predictions, and it’s important to review how those prior predictions turned out. Here’s a status report on those for which the two-year prediction period has passed. (There are three additional columns for which the jury is still out.) As you will see, of the five predictions for which the two-year period has passed, four were successful:

Nov. 27, 2017: I reported that the odds of bitcoin BTCUSD crashing were greater than 80%. The cryptocurrency was 60% lower just over a year later.Jun. 27, 2019: In this column I reported that bitcoin was “very likely to crash soon.” It was more than 50% lower in nine months’ time.Feb. 4, 2020: In this column I reported that Tesla Inc. TSLA was forming a bubble that was about to pop. In less than two months the stock was 60% lower.Feb. 15, 2021: In this column I reported that the “S&P 500 Technology Hardware, Storage & Peripherals index” was forming a “bubble at risk of bursting.” This prediction was not successful, as over the subsequent two years the index fell no lower than 13.1% below the index’s level when that column was published.Feb. 26, 2021: In this column I reported the significant probability that bitcoin would crash at some over the subsequent two years. In 18 months’ time it was 68% lower.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Is Nvidia doomed to be the next Cisco or Intel? Here’s what investors need to know.

Plus: Even the bulls are getting trampled by the tech-sector-heavy U.S. market. A melt-up could be coming.

-Mark Hulbert

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

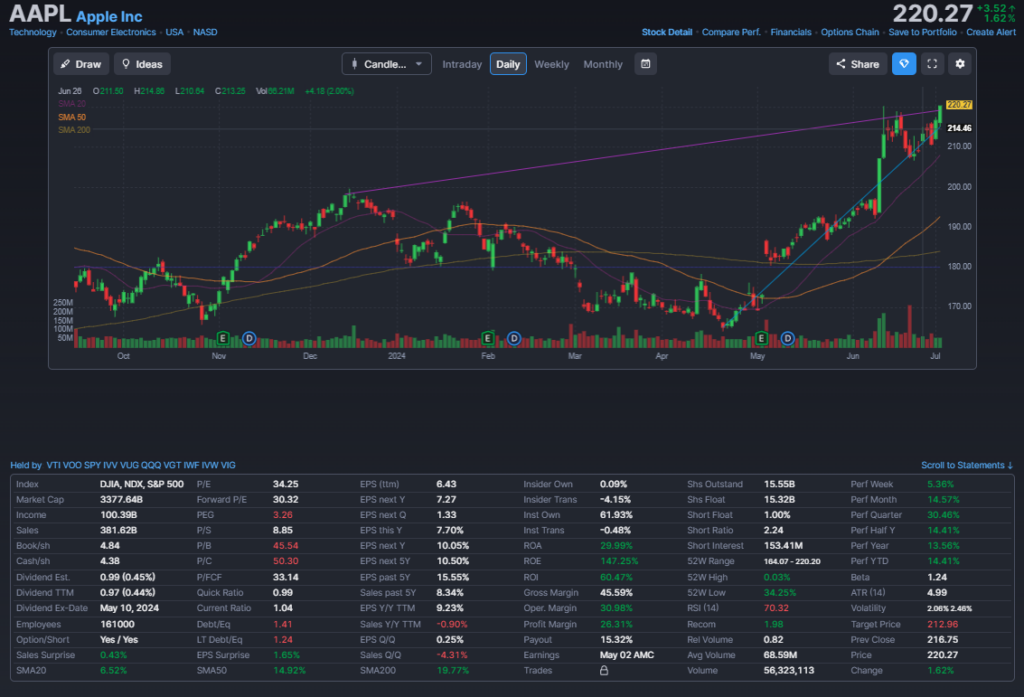

누가 애플 걱정을 하였는가? 4월이 매수 타이밍이 였다. 3월 4월 조정장에 추매하신 개미들이 승리다.4:38 AM EDT, July 02, 2024 (Benzinga Newswire)

Apple Inc. (NASDAQ:AAPL) is reportedly working on the next generation of its Vision Pro headset, with rumors suggesting significant changes in design and pricing.What Happened: The tech giant is developing two variants of the second-generation headset. One version is expected to be a premium option, improving upon the first Apple Vision Pro, while the other is anticipated to be a more affordable, consumer-grade edition.Apple’s first-generation headset, launched at WWDC 2023 and released in February 2024, has been praised for its design and utility in sectors like healthcare. However, its $3,500 price tag has reportedly hindered sales.See Also: Elon Musk Took A Cheeky Swipe At Jeff Bezos After Amazon Breached The $2 Trillion Market Cap: Here’s What The Famed Entrepreneur SaidRumors suggest that the consumer-grade version of the Apple Vision Pro follow-up could be significantly cheaper. Apple is reportedly aiming to reduce the bill of materials to half of what Vision Pro costs, potentially bringing the price down to between $1,500 to $2,500.To achieve this cost reduction, Apple may make significant cuts to some of its highest-priced components, such as the camera and sensor array, the use of two Apple Silicon chips, and twin 4K microLED displays. The new headset might also feature a simpler headband design and the use of AirPods for spatial audio.The tech giant could also eliminate the EyeSight display, which shows the user’s eyes externally, and reduce the specifications of the internal virtual reality screens.Moreover, unlike the first-generation Apple Vision Pro, which can operate independently, the next version might need to be tethered to a host device like an iPhone or Mac. This could help reduce onboard processing costs and introduce a “tier” system into the range.As for the next premium Vision Pro model, last month it was reported that Apple’s follow-up to the headset’s high-end model has been halted, in favor of developing a more affordable alternative, reported AppleInsider (via The Information).The tech giant is also reportedly working on reducing the weight of future Vision Pro headsets after considering feedback from many users.Why It Matters: In June 2023, Apple shares briefly surpassed the previous record of $182.94 set on January 4, 2022, reaching a new all-time high of $184.95. However, after the company unveiled its first augmented reality headset, the Apple Vision Pro, shares unexpectedly pulled back, contrary to many expectations.Last week, the company started selling its mixed-reality headset in China. However, the product’s price, approximately 18% higher than in the U.S., has ignited a debate among consumers.In May earlier this year, Apple reported its second-quarter results that outperformed muted goals. The tech giant reported quarterly revenue of $90.75 billion, a 4% decrease year-over-year, and quarterly earnings per diluted share of $1.53, according to Benzinga Pro data.Check out more of Benzinga’s Consumer Tech coverage by following this link.Read Next: Mark Zuckerberg’s PR Team Couldn’t Stop Him From Posting: ‘My Spine Has Been Surgically Removed,’ Said Former Facebook ExecDisclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.Photo courtesy: Shutterstock

Write to Benzinga at editorial@benzinga.com

제일 걱정은 미국으로 몰려든 자금이 빠져나갈 턴이 돌아오면 그땐 어떻게 할건가? 아직은 대안이 보이질 않는다 하지만 어떻게든 찾아서 옮겨 가겠지 그게 세상 이치가 아닐까? 근데 왜 내 자산은 늘지 않는 것인가?

어째든 오늘은 즐기자 기대하지도 않았던 상승을 추카!!